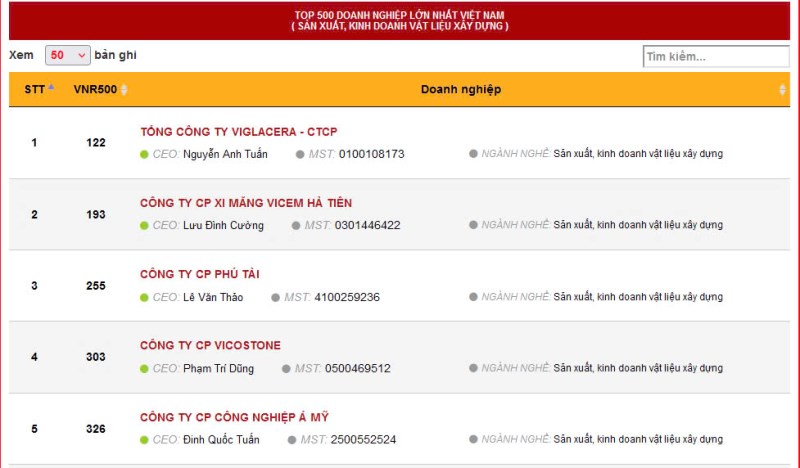

Viglacera continues to be in the Top 500 largest enterprises in Vietnam (VNR500) and tops the list of construction material manufacturing companies

The joy came right at the beginning of the new year 2025, as Viglacera Corporation – JSC continued to maintain its position in the Top 500 largest enterprises in Vietnam, and at the same time topped the list of construction material trading companies in Vietnam. Looking at the history of VNR500 from 2016 to present, Viglacera has been consistently ranked in the Top 500 largest enterprises in Vietnam.

This achievement is worthy of being a symbol of Viglacera Corporation’s persistent efforts in developing production, improving competitiveness and innovation. Viglacera has continuously invested in depth, upgraded its technological lines, especially focused on green technologies, creating solutions for building materials that meet the criteria of being environmentally friendly.

To have many consecutive years of achievements in VNR500, it is necessary to mention the extremely important role of real estate investment and business activities. Viglacera is also one of the largest and most prestigious real estate developers in Vietnam with 16 industrial parks, attracting up to 18 billion USD in foreign investment capital; is the investor of 18 urban and residential areas; 1 5-star hotel project. In 2024 alone, Viglacera was granted investment certificates by the Government for 2 new industrial parks, Song Cong 2 Industrial Park – phase 2 (Song Cong – Thai Nguyen) and Tran Yen Industrial Park (Yen Bai) with an additional area of 550.83 hectares. Thuan Thanh Eco – Smart IP of Viglacera also officially announced the development in the direction of green & smart industrial park. Dong Van 4 Service Area and Workers’ Housing Project in Kim Bang District, Ha Nam Province was honored to receive the “Worth Living Project” award.

It can be said that Viglacera’s position in the Top 500 companies of the VNR 500 ranking serves as a motivational boost as the company welcomes the year 2025. This recognition also reflects the acknowledgment from society and reputable organizations that assess and rank businesses, highlighting the achievements of an entity with a 50-year history of development and growth.These noble awards will also contribute to creating a more solid foundation for Viglacera to continue its mission of pioneering green technology, creating a civilized, modern and convenient life, while also aiming to enhance the brand position, improve the quality of Viglacera’s products and services in the domestic and international markets.

About the VNR 500 ranking:

The VNR500 ranking is based on the results of independent research and evaluation by Vietnam Report Joint Stock Company, combining analysis on criteria of actual revenue of enterprises, total assets, total labor, after tax profit and other indicators such as: profitability index ROA, ROE, media reputation of enterprises.

- Published in News

The President of Cuba highly appreciates Viglacera’s cooperation

On December 12, 2024, local time, in Havana, Cuba, Chairman of the Board of Directors of Viglacera Corporation – JSC Nguyen Van Tuan had a meeting with the First Secretary of the Communist Party of Cuba, President of Cuba Miguel Mario Díaz-Canel Bermúdez.

Reporting to the President of Cuba, Mr. Miguel Mario Díaz-Canel Bermúdez, Mr. Nguyen Van Tuan – affirmed that after 6 years of operation, up to now, the ViMariel Industrial Park invested by Viglacera in the Mariel Special Economic Zone has contributed to promoting production and business activities, meeting the demand for goods for the Cuban market, creating more jobs for Cuban workers.

Chairman of the Board of Directors of Viglacera Corporation – JSC Nguyen Van Tuan met with the First Secretary of the Communist Party of Cuba, President of Cuba Miguel Mario Díaz-Canel Bermúdez.

In addition to ViMariel Industrial Park, Viglacera has contributed capital to establish Sanvig Joint Venture Company since November 2019, operating in the field of construction materials production. SanVig Joint Venture not only supplies goods to the domestic market, contributing to promoting the construction market in Cuba, but also exports, bringing foreign currency to Cuba.

ViMariel Industrial Park of Viglacera Corporation is Cuba’s first limited-term concession project for a 100% foreign-owned enterprise.

At the meeting, Mr. Miguel Mario Díaz-Canel Bermúdez expressed his excitement and welcomed Viglacera and Vietnamese enterprises to invest and cooperate in business in Cuba. The Cuban President reiterated the friendly and sincere relationship between Vietnam and Cuba, affirming that the two governments strongly support investment and business cooperation activities between enterprises of the two countries.

Since the visit and working session in Cuba in October 2024 by General Secretary of the Communist Party of Vietnam To Lam, Viglacera Corporation has actively promoted investment and cooperation activities with this country, in which in addition to industrial parks and construction materials, cooperation in pharmaceuticals, especially biotechnology products, is a new direction. At the same time, Viglacera and GELEX Group also support Cuba in the fields of agriculture, energy and technology.

Mr. Nguyen Van Tuan expressed his deep gratitude to Mr. Miguel Mario Díaz-Canel Bermúdez for the support of the Cuban Government for the activities of GELEX and Viglacera in Cuba in the past time, expressed his belief in the prospects of investment, business in Cuba and cooperation with Cuban enterprises, and made several proposals to help promote cooperation between enterprises of the two countries.

Currently, Vietnam is the second largest Asian trading partner and the largest foreign investor in Asia in Cuba with 6 projects implemented.

Cuba is committed to always welcoming and accompanying Vietnamese investors. The Cuban government will look for mechanisms and solutions to facilitate the activities of Vietnamese enterprises investing in Cuba.

- Published in News

Incentive mechanisms needed for semiconductor industry: PM

Prime Minister Pham Minh Chinh, Head of the National Steering Committee for Semiconductor Industry Development, urged the development of incentive mechanisms and policies to promote the development of the semiconductor industry, while chairing the first meeting of the committee in Hanoi on December 14 morning.

Prime Minister Pham Minh Chinh at the meeting

Emphasising that developing the semiconductor industry is a necessity, a strategic breakthrough, and also a key task in the coming time, the PM said that it requires the participation of the entire political system, the engagement of people, businesses, investors, and the support of international friends.

The determination to implement the scheme must be demonstrated through specific, methodical, scientific, and drastic actions, he stressed…

The PM urged establishing an investment support fund, transferring technology, and optimising Vietnam’s potential, opportunities, and competitive advantages.

Source: VietnamPlus

- Published in News

Quang Ninh – Linking forum to promote smart manufacturing supply chain

On December 12, VCCI organized the Eastern Expressway Industrial Park Forum 2024 with the theme “Linking to promote smart manufacturing supply chain”.

The forum was held in Ha Long City, this is a conference aimed at gradually creating links and connecting regions, forming a development cooperation network and forming a smart production chain, promoting growth.

Attending the conference were Mr. Pham Tan Cong, Chairman of the Vietnam Federation of Commerce and Industry (VCCI), and leaders of Quang Ninh, Hung Yen, Hai Duong and Hai Phong city.

In July 2022, the Eastern Expressway Economic Connection Agreement was signed between VCCI and 4 localities including Quang Ninh, Hai Phong, Hai Duong, and Hung Yen. This is an initiative in implementing the Party and State’s policy on regional connectivity, promoting the potential and advantages of each locality.

Mr. Pham Tan Cong at the conference.

Speaking at the opening of the conference, Mr. Pham Tan Cong affirmed that Resolution 30-NQ/TW of the Politburo on socio-economic development and ensuring national defense and security in the Red River Delta region to 2030, with a vision to 2045, emphasized the role of the Red River Delta as a driving force for national economic development, prioritizing industrial modernization, expanding infrastructure and implementing sustainable development policies.

The resolution aims to build advanced industrial clusters, modern logistics networks and sustainable resource management to create a sustainable and globally competitive economy.

The forum is an opportunity for state agencies and businesses to share experiences, discuss solutions to promote smart manufacturing supply chains and build cooperative relationships with international businesses and organizations.

Source: Kinh tế & Đô thị

- Published in News