The meeting of generations “Faithful like the color of red bricks…”

Nearly 100 former leaders of Viglacera Corporation and its member units shared the joy of reunion on a very special occasion. That was the Meeting Gala with generations of leaders of the Corporation and its member units, on the occasion of the 50th Tradition anniversary of Viglacera, which took place on June 26 at Angsana Quan Lan Resort. This is a 5-star resort project invested by Viglacera and is about to be put into operation.

In a speech welcoming and expressing gratitude to generations of Viglacera employees and workers over the past 5 decades, Mr. Nguyen Quy Tuan, Chairman of the Corporation’s Trade Union, emphasized: “Throughout 50 years of construction and development, overcoming many ups and downs, despite difficulties and challenges, Viglacera Corporation has achieved many miracles, affirming its position and important role in the construction industry, contributing to the country’s socio-economic achievements. Viglacera today has new achievements and goals, but always grateful to the uncles, brothers and sisters who have left their mark and great contributions to Viglacera over the past 50 years.”

Mr. Dinh Quang Huy, former General Director of the Corporation, and Mr. Nguyen Ba Khien, former Chairman of the Corporation’s Trade Union, spoke at the meeting, reviewing Viglacera’s glorious achievements and recognizing the contributions of today’s generation. They also sent good health wishes and thanks to the Board of Directors of Viglacera Corporation for always creating conditions to continue the tradition of solidarity and glory of the Corporation.

Also at this meeting, on the meaningful occasion of celebrating the 50th anniversary of the Corporation’s tradition, representatives of generations of Viglacera workers together looked back at the glorious milestones and achievements – created by their own minds, hands and sweat.

Other images at the metting:

Other images of the Angsana Quan Lan Resort – the 5-star resort project invested by Viglacera:

- Published in News

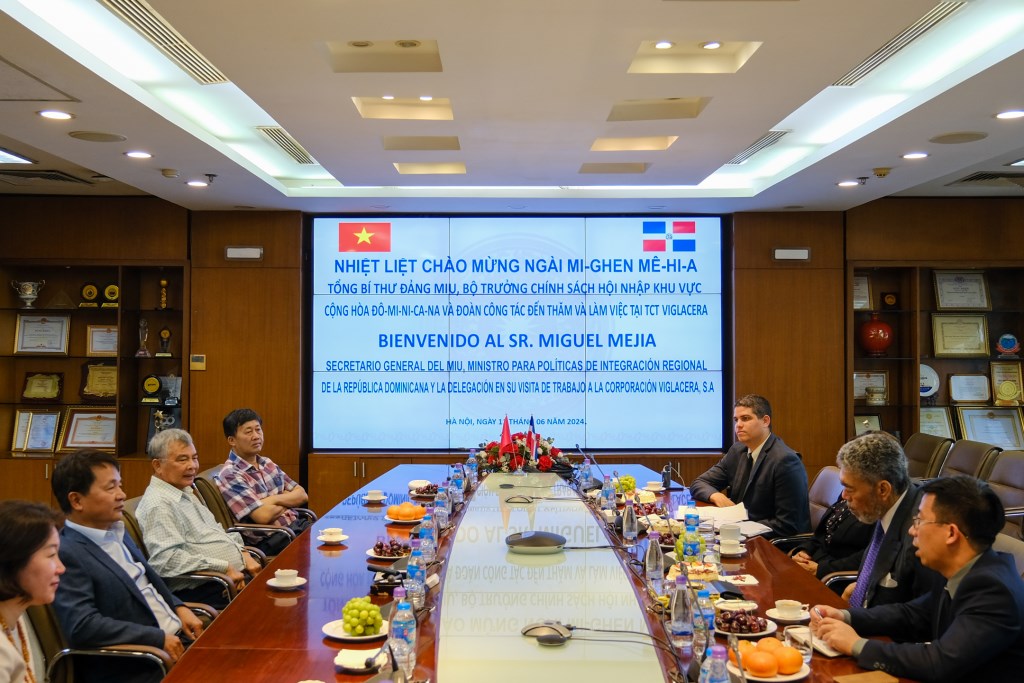

General Secretary of the United Left Wing Party (MIU – Dominican Republic) visited and worked at Viglacera Corporation-JSC

On June 11, at the Headquarters of Viglacera Corporation – JSC, General Director Nguyen Anh Tuan and representatives of the Corporation’s Board of Directors welcomed Mr. Miguel Mejia – General Secretary of the United Left Wing Party (MIU), Minister of Regional Integration Policy of the Dominican Republic and the joint delegation of the Ministry of Construction – Ministry of Industry and Trade (Vietnam).

After the welcoming ceremony, the atmosphere was full of intimacy and sincerity. At the beginning of the meeting, General Director Nguyen Anh Tuan congratulated the cooperation between Vietnam and the Dominican Republic that has increasingly developed and expanded in many fields in recent times. The General Director also sent greetings and congratulations on the achievements of Dominican President – Mr. Luis Rodolfo Abinader Corona.

In his response, the General Secretary of the MIU Party thanked Viglacera leaders for the warm welcome. He also expressed the Dominican Government’s aspirations for extensive cooperation programs with Vietnamese enterprises, notably Viglacera. He and his Government greatly admire Viglacera’s strengths in producing construction materials, developing real estate projects and industrial parks. He also especially sent President Luis Abinader’s invitation to Viglacera Corporation about always being ready to welcome and create the best conditions to participate in investment and production development in your country – which has a favourable strategic location, while emphasizing the hope for deeper cooperation in developing the field of social housing, a field in which Viglacera has a lot of experience and achievements.

Viglacera General Director Nguyen Anh Tuan replied that Viglacera always wants to bring its construction materials to the world, especially the markets of Central American and Caribbean countries, of which Dominicana is a country with great potential.

Mr Miguel Mejía emphasized that if Viglacera Corporation invests in production in the Dominican Republic, it can also export goods to neighboring countries thanks to the good economic relations of the neighboring countries. Therefore, the General Secretary of the MIU Party hopes that the two sides will soon implement the content of cooperation to promote the appearance of Vietnamese enterprises in the Dominican Republic.

At the end of the meeting, the delegation visited the display of Viglacera’s latest construction materials products. Here, the General Secretary of the MIU Party Miguel Mejía was very impressed by the sophistication and class of these products. He once again reiterated his wish for the presence of construction materials and other construction investment products under the Viglacera brand in the Dominican Republic in the near future.

- Published in News

Annual General Meeting of Shareholders of Viglacera Corporation – JSC: Dividend of 22.5%, higher than the original plan

On May 29, 2024, in Hanoi, Viglacera Corporation – Joint Stock Company (VGC; HOSE) organized the 2024 Annual General Meeting of Shareholders (AGM) and approved the main contents of the Meeting.

Overview of the 2024 Annual General Meeting of Shareholders 2024

Profit before tax reached 132% of the plan

Accordingly, in 2023, the consolidated pre-tax profit of Viglacera Corporation – JSC was 1,602 billion VND, reaching 132% of the year plan. In particular, the parent company showed its leading role with net revenue of 5,337 billion VND, pre-tax profit of 1,911 billion VND, reaching 146% of the year plan, an increase of 201 billion VND compared to 2022. Finance of the parent company was operated, used and preserved capital effectively; growing in profit. The parent company’s return on total assets (ROA) was 10.7%; Return on equity (ROE) was 22.1%.

Mr. Tran Ngoc Anh, Member of the Board of Directors of the Corporation, presented the Report of the Board of Directors

Also in 2023, the Corporation’s export turnover was recorded to reach 46.3 million USD, increasing by 53%. The General Meeting of Shareholders approved a 22.5% cash dividend, 20% higher than the plan approved by the General Meeting of Shareholders.

In 2024, real estate continues to play a key role

At the Congress, Viglacera’s Board of Directors submitted to shareholders for approval the 2024 production and business plan with total consolidated revenue of 13,353 billion VND, slightly increasing compared to 2023 results and consolidated pre-tax profit of 1,110 billion VND. copper.

In the context of difficulties in the materials sector and the need to restructure production units in the direction of increasing labor productivity, reducing costs, Viglacera determines that real estate will continue to be a key segment in 2024 of the Corporation.

Accordingly, Viglacera will focus on exploiting Yen My, Phong Dien, Thuan Thanh, Tien Hai, Yen Phong 2C, Dong Mai, Yen Phong (Expansion Phase), Dong Van IV industrial park projects with a business target of approximately 173 hectares in 2024.

At the same time, conduct surveys and propose to prepare documents for investment policy approval and developer approval to deploy investment in new industrial parks in localities with advantageous infrastructure and locations, investment attraction and business capabilities..

The Corporation will also establish new legal entities and branches to implement projects such as Phu Ninh Industrial Park (400ha), Bac Son Industrial Park (200ha) in Phu Tho; Expanded Dong Mai Industrial Park (150ha) in Quang Ninh; Tran Yen Industrial Park (255 hectares) in Yen Bai; Tay Pho Yen Industrial Park (868ha), Song Cong 2 Industrial Park (296 ha) in Thai Nguyen; Industrial Park No. 1 (260 hectares) in Hung Yen; Doc Da Trang Industrial Park (288 hectares) in Khanh Hoa; industrial parks in Bac Ninh, Quang Ninh, Tuyen Quang, Lao Cai, Lang Son, Hung Yen…, industrial parks in the South and other locations.

In the field of social housing and worker housing, Viglacera will continue to invest in 50,000 social housing units (under the new development program of 1 million social housing units for the period 2023 – 2030) assigned by the Ministry of Construction at the “Conference to promote the development of social housing for workers and low-income people” organized by the Prime Minister in 2023.

Mr. Tran Manh Huu, Head of the Supervisory Board of the Corporation, presented the Report of the Supervisory Board

In addition, Viglacera plans to continue developing social housing areas in sync with the development of existing industrial parks, preparing to invest in new key projects in industrial parks of Dong Van IV, Phu Ha, Dong Mai, Yen Phong; Social housing in Kim Chung (CT3-CT4); continue to carry out investment preparations for social housing projects in Tien Hai Industrial Park (5.2ha), Phu Ha Industrial Park (8.4ha); continue to participate in the selection of investors for the Social Housing project in Tien Duong – Dong Anh.

The Corporation plans to continue to invest in commercial services in Dang Xa, Xuan Phuong (Hanoi), and Yen Phong (Bac Ninh) urban areas. At the same time, implement steps to prepare for investment in developing new industrial parks…; continue to implement the Van Hai luxury eco-tourism area project phase 1 (area of 35 hectares), thereby completing and putting into operation an international 5-star hotel, and at the same time implementing the initial steps of preparation investment for phase 2 with an area of 40 hectares.

Mr. Le Dong Thanh, member of the Equitization Steering Committee (Ministry of Construction), gave a directive speech at the Congress

One of the key tasks of this year is to continue implementing the preparation steps as well as procedures for the divestment of State capital at the Corporation according to the policies and directions of the Ministry of Construction; Decision No. 1479/QD-TTg dated November 29, 2022 of the Prime Minister.

In 2024, Viglacera is expected to continue paying dividends by cash at a rate of 20%

The Presidium conducted a discussion session with shareholders at the Congress

Also at the Congress, leaders of Viglacera Corporation – JSC informed a number of contents and areas of interest to shareholders such as: industrial real estate; estimated selling price, revenue, profit of social housing; construction materials segment, including super white glass, prospects for recovery of construction materials segment in the next 3 years; divestment plan…

Elect members of the Board of Directors and Supervisory Board

In the morning, General Meeting of Shareholders of Viglacera Corporation – JSC also elected the members of the Board of Directors and members of the Supervisory Board of the Corporation for the term 2024 – 2029.

Accordingly, the major shareholder, Gelex Infrastructure Joint Stock Company (a subsidiary of which Gelex holds nearly 97% of voting rights), nominated three candidates for the position of members of the Board of Directors including: Mr. Nguyen Van Tuan, Mr. Le Ba Tho, Mr. Nguyen Trong Hien and nominated two members of the Supervisory Board including: Mr. Tran Manh Huu, Ms. Nguyen Thi Tham.

The Ministry of Construction appointed two representatives of the State capital to serve as members of the Board of Directors, including: Mr. Tran Ngoc Anh, Member of the Board of Directors, Deputy General Director of the Corporation (managing 25% of capital) and Ms. Tran Thi Minh Loan, Member of the Board of Directors, Director of Finance and Accounting Department of the Corporation (managing 13.58% of capital).

The Congress approved 100% of the election of members of the Board of Directors: 5 members; Supervisory Board members: 3 members

Board of Directors of Viglacera Corporation – Joint Stock Company for the term 2024-2029 debuts at the Congress

Board of Supervisors of Viglacera Corporation – Joint Stock Company for the term 2024-2029 debuts at the Congress

The annual General Meeting of Shareholders of Viglacera Corporation – JSC unanimously approved the 2023 financial report (audited), profit distribution plan, 2023 dividend payment plan, production and investment plan targets in 2024 along with other important contents.

Other images at the Congres:

- Published in News

Viglacera’s Production and Business Results for April 2024

On the morning of May 6, 2024, Viglacera held a monthly meeting to assess preliminary production and business activities for April 2024 and to discuss the production and business plan and key tasks for May 2024.

Full view of the meeting

In April, Viglacera consolidated profit reached VND 29.2 billion. Accumulated profit in the first four months of the year is estimated to reach 31% of the annual plan, an increase of VND 143.5 billion compared to the same period in 2023.

Industrial Park (IP) real estate continues to be a bright spot

Total revenue from the real estate business segment in April is estimated to reach VND 267 billion, achieving 101% of the monthly plan. This demonstrates the stability and development potential of this field in Viglacera’s business strategy.

The direction from the Board of Directors and the Executive Board is to continue to focus resources and more vigorously implement land acquisition and clearance work, invest in IP infrastructure, ensure construction progress and meet market demand, and expand new land funds to enhance value.

At the same time, apply green and smart standards to the next IP projects with core objectives incorporated into the action plan.

Continue to focus on improving the efficiency of construction materials production

Recognizing the common difficulties of the real estate market, Viglacera has developed appropriate response strategies to maintain growth momentum and ensure business efficiency. Viglacera’s leadership has directed the business team to regularly monitor market developments, update customer needs to coordinate with factories to establish and adjust production and business plans accordingly; Strengthen coordination between production and business units to ensure the supply of goods, focus on promoting sales activities, and ensure operating cash flow.

In addition, Viglacera has implemented specific measures such as controlling costs and reducing production costs to optimize performance and profit. Focus on expanding the consumption market, especially in regions such as the Central and Southern regions in Vietnam. In a period of market difficulties, the Corporation’s leadership also directed the focus on internal management work to ensure flexible, effective business operations and compliance with legal regulations.

Also in April, Viglacera urged and supervised the implementation of the Annual Shareholders’ Meeting and Annual Conference of Employees of member companies and associates. On the basis of the key tasks set out, the Corporation will focus on implementing specific solutions for each field and prepare to organize the Corporation’s Annual General Meeting of Shareholders at the end of this May.

- Published in News