Top 10 outstanding events of Viglacera Corporation – JSC in 2021

Efforts to realize the “dual goals” of both fighting the Covid-19 epidemic and developing production have helped Viglacera continue to maintain its position as a pioneer in the manufacturing industry of construction materials and investment in real estate business in Vietnam. Below are Viglacera’s outstanding events in 2021:

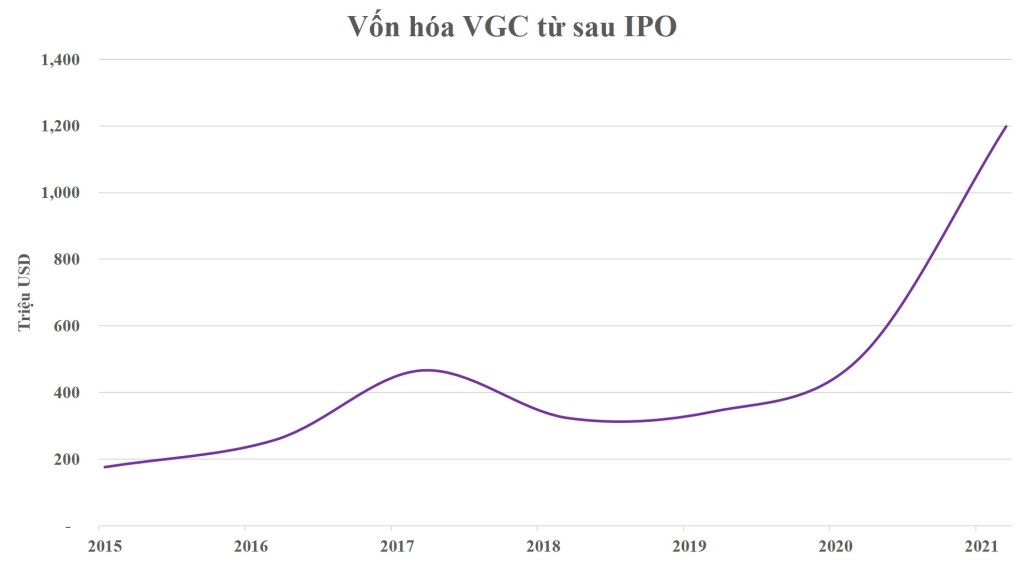

1. The capitalization of Viglacera Corporation (VGC) on the stock market reached over 1 billion USD

Viglacera performed IPO in 2014 and started trading shares on Upcom from the fourth quarter of 2015 with a market capitalization of about 130 million USD, reaching over 450 million USD in 2017 and over 1 billion USD in mid-December 2021. According to data from the Ho Chi Minh Stock Exchange (HoSE), by the end of November 2021, there were 45 enterprises with a market capitalization of over 1 billion USD, including the presence of Viglacera Corporation – known as VGC code.

This is a recognition of Viglacera’s impressive growth results and sustainable development priorities, and at the same time affirms the Corporation’s comprehensive initiative and risk management ability in all activities, as well as the flexible and responsive adaptation to all market fluctuations.

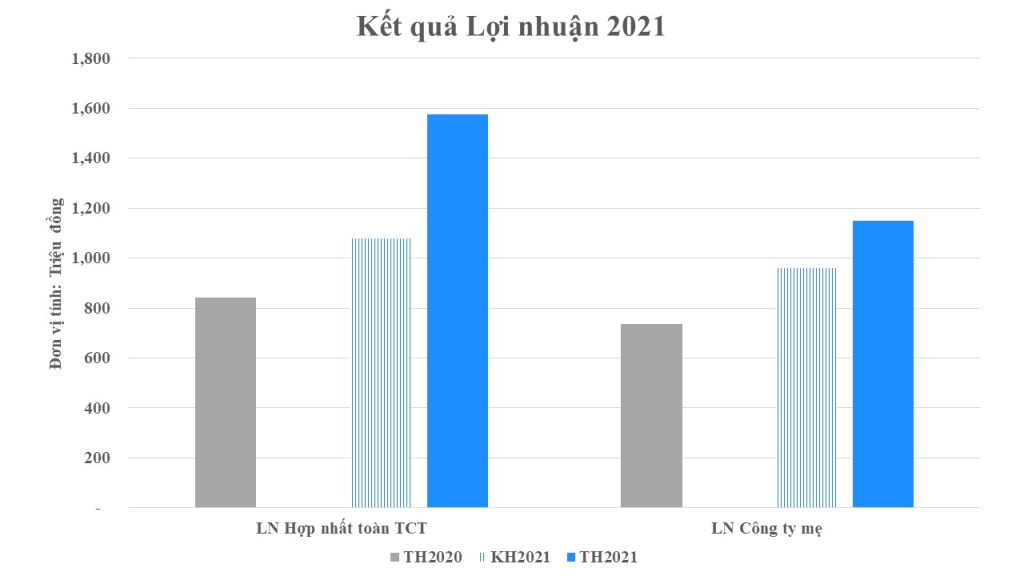

2. In the first year, the parent company’s profit reached over VND 1,000 billion

Despite the impact of the Covid 19 pandemic, under the drastic, proactive and flexible management of the VGC’s Board of Directors along with the consensus of all employees, the business performance of the whole Corporation in 2021 has exceeded the main targets. Profit before tax of the whole Corporation was estimated at 1,575 billion VND, reaching 146% of the year plan, of which the profit of the parent company was estimated at over 1,100 billion VND, up 20% compared to the plan in 2021 and up 56% compared to that in 2020.

3. Raised the capital ownership ratio in Phu My Super White Float Glass Company to 65%, recording the first year’s business performance exceeding the project’s target plan

2021 was also the year marking the event that VGC increased its ownership in Phu My Super White Float Glass Company Limited (PFG) from 35% to 65% of charter capital and transferred from an associate to a subsidiary from 1st. October 2021.

Officially put into production in December 2020, Phu My super white float glass factory phase I has a capacity of 600 tons/day. Right in the first year that PFG went into production, it exceeded the project plan and target. This is a great outcome of Viglacera Corporation’s well-planned investment strategy.

4. Viglacera acquired Bach Ma factory and invested in Continua+ technology to produce high-class large-format porcelain plates

With the acquisition of Bach Ma Factory, Viglacera currently owns 8 manufacturing factories nationwide with a total capacity of 43 million m2/year. Viglacera is also one of the first enterprises in Vietnam to invest in the world’s most modern production line to produce large porcelain plates using Continua+ technology of Sacmi (Italy) at Viglacera My Duc 2 Factory. The line has been updated with SACMI’s latest decorative printing and product forming technologies to create high-quality large-format porcelain plates with transparent veins (3,200mm x 1,600mm). This is part of the strategy to improve production capacity, expand markets, and affirm Viglacera’s vision and product development orientation in the high-end segment.

5. Expand investment in industrial zones in new areas and attract investors in the high-tech sector to invest billions of dollars

In 2021, the Corporation focused on investment and development, expanding the land fund of industrial zones, expanding investment in new areas, and continuing to affirm its position as one of the leading enterprises in the field of real estate industry and worker accommodation.

In the context of the current Covid-19 epidemic, a very large project of 1.6 billion USD of Amkor – the world’s leading corporation in the production of semiconductor materials has been invested in Yen Phong II-C Industrial park of Bac Ninh province. Thereby, Viglacera has affirmed its attraction to go ahead with the shifting trend of the world’s supply chains into Vietnam, as well as created a premise for the development of the high-tech industry in the following years.

6. Prestigious awards and outstanding achievements: Top 50 best listed companies on the stock exchange (Forbes), Top 10 prestigious IP and real estate companies in 2021, Top 5 prestigious construction companies – Building materials industry 2021 (VNR500)

With the orientation of building and implementing a sustainable growth strategy, Viglacera has been constantly trying to improve product quality, applying high technology, smart technology to research and develop green, environmental friendliness products. Recorded in 2021, Viglacera has been honored to receive many prestigious awards in the field of Construction such as 3 consecutive years holding the leading position in the Top 10 prestigious IP and real estate companies in 2021; Top 5 prestigious construction companies – building materials in 2021 and Top 50 best listed companies on the stock market in 2021 by Forbes Vietnam. In addition, Viglacera still maintains its National Brand and National Quality.

7. Viglacera made its mark on the map of Top manufacturers of ceramic tiles and sanitary ware in the world

Viglacera is the only building materials manufacturing enterprise nominated by Vietnam to attend and was honored in the highest category: World Class Award for large production in the Asia-Pacific International Quality Award. By the end of 2021, Viglacera also entered the Top 20 manufacturers of ceramic tiles and the Top 30 largest manufacturers of sanitary ware in the world.

8. Brand value of Viglacera is assessed in the Top 50 most valuable brands in Vietnam (according to Brand finance)

The brand value of Viglacera is valued at over $59 million and in the top 50 most valuable brands in Vietnam in 2021 (according to a report by Brand Finance).

This growth demonstrates the internal strength of Viglacera’s brand value, besides financial indicators, there are also great strides in customer satisfaction from products and services provided by Viglacera. With steady progress, VIGLACERA Corporation will continue to strive to maintain its leading position in the field of building materials production and investment, real estate business in Vietnam, stably and sustainably developing to assert its position in the international arena.

9. Corporate governance: using professional consulting services according to international standards

During its development course, Viglacera always considers transparency and professionalism as the core foundation in governance. From the above commitment, Viglacera has gradually implemented and developed corporate governance such as using professional consulting services in accordance with international standards, Big4, Deloitte and PWC (PricewaterhouseCoopers) are currently consulting agencies for internal audit activities of the Corporation.

10. Join hands with the community to prevent the Covid-19 epidemic

In addition to proactively developing an epidemic prevention plan throughout the Corporation, in the 4th outbreak from the beginning of May 2021 until now, Viglacera has contributed over 20 billion VND through the Fatherland Front Committee in localities and the Government’s vaccine funds.

In particular, in response to the complicated situation of the Covid-19 epidemic in Hanoi, Viglacera Corporation quickly implemented a project to sponsor sanitary equipment and tiles installed in an on-the-site hospital for the treatment of Covid-19 patients. Viglacera has installed sanitary ware and tiles in more than 100 sanitary areas in the hospital. Products with antibacterial features will help doctors and frontline workers fight the epidemic.

- Published in News

The world’s leading group in semiconductor manufacturing – Amkor Technology decided to setup a factory in Yen Phong II-C Industrial Park, Bac Ninh

Recently, Amkor Technology, Inc. and Viglacera Real Estate Company (Viglacera Corporation – JSC) signed a contract in principle to lease land to invest in building a project for manufacturing, assembling and testing semiconductor materials. In the context of the current Covid-19 pandemic, with Amkor’s huge $1.6 billion project invested in Yen Phong II-C Industrial Park in Bac Ninh province – Viglacera has continued to affirm its attraction in the trend of shifting supply chains in the world into Vietnam, as well as creating a premise for the development of high-tech industry in the following years.

Signing ceremony between Viglacera Real Estate Company (Viglacera Corporation – JSC) and Amkor Technology Group at Bac Ninh Provincial People’s Committee

After a period of careful survey and research, Viglacera’s Yen Phong II-C Industrial Park in Bac Ninh has been selected by Amkor Technology Group as the stopover for the first factory in Vietnam, in its global assembly and testing network.

Before the signing ceremony, Mr. Ji Jong Rip – Chairman of Amkor Company and Amkor Technology delegation had a meeting with investor Viglacera at Yen Phong II-C Industrial Park. Here, Mr. Ji Jong Rip said, along with the favorable investment environment in Bac Ninh province, he was very impressed with the location and modern infrastructure – technical infrastructure, synchronous services developed by Viglacera, this is the basis for the company to choose to invest in Yen Phong II-C Industrial Park. Mr. Ji Jong Rip committed to making every effort to create the success of the semiconductor industry in Bac Ninh province by successfully building Amkor factory in Yen Phong II-C industrial park.

Amkor’s side also affirmed, “The factory in Yen Phong II-C, Bac Ninh is a long-term, strategic investment in terms of geographical diversification and expansion of factory capacity, supporting the company’s commitment for reliable supply chain solutions for customers.”

General Director Ji Jong Rip and Amkor Technology work at Yen Phong II-C Industrial Park

Amkor’s factory in Yen Phong II-C Industrial Park has a scale of 230,000 m 2 , with a total investment capital of up to 1.6 billion USD. The first phase of the project at Yen Phong II-C Industrial Park will focus on the production, assembly and testing of semiconductor materials (Advanced System in Package) for the world’s leading semiconductor and electronic manufacturing companies. The project is expected to start construction in 2022 and large quantities of products will begin production in the second half of 2023.

In addition to appreciating the synchronous technical infrastructure system at the Yen Phong – Yen Phong II-C industrial park complex, Amkor Group also shows its interest in service and utility infrastructure in the industrial park to ensure quality of life as well as spiritual culture for experts and workers working at the factory.

Housing project for experts and workers located in the complex of Yen Phong Industrial Park – Yen Phong II-C

Within the working framework, General Director Ji Jong Rip and Amkor delegation visited the housing project for experts and workers located in Yen Phong Industrial Park. The project has a scale of 20ha, with adjacent apartments, condominiums and utilities such as restaurants and supermarkets that will accommodate nearly 6000 experts and workers. In particular, a complex of multi-functional works – Cultural and social housing institution area includes: 01 Primary school (size of 15 classes), 01 Kindergarten (scale of 12 classes), House of Culture (serving about 1,000 people at the same time), the health station and green park, the gymnasium, etc. Were invested and built on an area of 17,000m2, is a clear proof that Viglacera is not only always a pioneer in the development of industrial park infrastructure, but also in synchronous investment in urban areas associated with industrial parks, with the goal of meeting the needs of accommodation in the best way for working, living and traveling of employees, indirectly supporting costs and creating abundant human resources for businesses operating in Viglacera’s IPs.

Established in 1968, with headquarters in Arizona, USA and 17 factories in Mainland China, Japan, Korea, Malaysia, Philippines, Portugal and Taiwan (China), Amkor Technology, Inc. is considered one of the world’s largest manufacturers, assemblers and testers of semiconductor materials, and is currently a strategic manufacturing partner for the world’s leading chip companies, chip foundries and microchips such as Qualcomm, Samsung, NVIDIA, Foxconn, Broadcom, LG, SK Hynix.

Started construction and development from 2020, with an area of 221ha, located in the Urban Complex of Yen Phong Industrial Park – Yen Phong Industrial Park II-C, with technical infrastructure, services, housing and utilities complete, synchronously located close to the industrial park, with a prime location only 20km (20′) from Noi Bai airport, 34km (45′) from Hanoi capital, Yen Phong II-C Industrial Park has been the destination of many big brands from Vietnam and Korea such as Hyosung TNS, TLB, .. and continues to promise to become a bright spot to attract investment in Bac Ninh province in the near future. Visit the industrial park through 360o virtual reality tour here: Yen Phong Industrial Park – Yen Phong II-C: YEN PHONG 360 – VIGLACERAIP

For more information, please contact: Viglacera Real Estate Company – Phone: (+84) 888 25 22 88 | Website: https://viglaceraip.com/

The signing ceremony was broadcast on Bac Ninh TV

General Director Ji Jong Rip and Amkor delegation visited and worked at Yen Phong II-C Industrial Park, Bac Ninh

General Director Ji Jong Rip and Amkor delegation visited housing project for experts and workers (20ha) located in Yen Phong – Yen Phong II-C Industrial Park Complex

- Published in News

Viglacera – the leading investment destination amid the pandemic storm

The return of the recent Covid-19 wave has created challenges when choosing investment for FDI enterprises not only in Vietnam but also in other countries around the world. However, the key point here is not just the epidemic, but how effectively the country responds to the epidemic. Thanks to good anti-epidemic ability and measures to support businesses to maintain stable production, Viglacera’s industrial parks (IPs) in Vietnam continue to be a reliable destination for investors around the world.

Although the COVID-19 pandemic has had a significant impact on production and business activities, recent positive data confirm that Vietnam is still an attractive investment destination for foreign businesses such as Singapore, Korea, China, Japan, with health measures, epidemic control, as well as economic recovery programs, business support, tax incentives of the Vietnamese government.

In line with that trend, Viglacera’s industrial parks (IPs) in Vietnam continue to be a reliable destination for investors. Facing optimistic forecasts about the economic recovery in the period of 2021 – 2022, Viglacera investor has been focusing resources on site clearance and infrastructure improvement in industrial parks to keep up with the demand for land for industrial production, welcome the next wave of investment.

Despite the complicated developments of the Covid-19 epidemic, up to now, Viglacera is still a reliable destination for many foreign investors, with the presence of large manufacturing and technology corporations, multinational corporations from China, Korea, etc.. with investment capital up to hundreds of millions of dollars.

Viglacera’s IPs with synchronous infrastructure still receive attention from many domestic and regional investors.

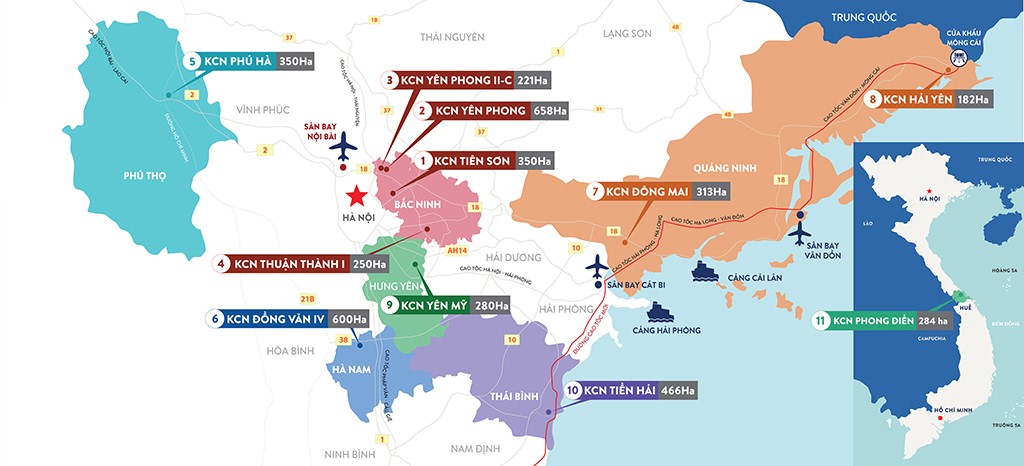

Location map of Viglacera’s industrial parks in Vietnam (Phu Tho, Bac Ninh, Hung Yen, Ha Nam, Thai Binh, Quang Ninh, Thua Thien Hue)

Up to now, Viglacera has developed 11 industrial parks in Vietnam and one economic park in Cuba, attracting nearly 15 billion USD in FDI from more than 300 domestic and foreign enterprises, creating jobs for tens of thousands of labors in the region. Thanks to the advantage of location in many provinces, Viglacera’s IPs bring diverse choices for investors, meeting the needs of each business. Industrial parks all have clean land and complete, synchronous and modern infrastructure, ready to welcome businesses to rent and build factories.

Viglacera is a leading industrial park developer in Vietnam with more than 20 years of experience, the list of operating industrial parks of Viglacera includes: Tien Son Industrial Park (Bac Ninh), Yen Phong Industrial Park (Bac Ninh), Yen Phong Industrial Park 2C (Bac Ninh), Phu Ha Industrial Park (Phu Tho), Hai Yen Industrial Park (Quang Ninh), Dong Mai Industrial Park (Quang Ninh), Tien Hai Industrial Park (Thai Binh), Dong Van IV Industrial Park (Ha Nam), Phong Dien Industrial Park (Thua Thien Hue), Yen My Industrial Park (Hung Yen), ViMariel Economic Zone (Cuba). It is expected that the investor will start construction of Thuan Thanh Industrial Park (Bac Ninh) in the first quarter of 2022.

Visit the industrial park through 360 virtual reality tour:

Yen Phong Industrial Park – Yen Phong 2C: https://yenphong360.viglaceraip.com

Phu Ha Industrial Park: https://phuha360.viglaceraip.com

For more information, please contact the hotline: (+84) 888 25 22 88 | Website: https://viglaceraip.com

- Published in News

Viglacera: Transform “acceleration” during the pandemic

In the challenge of complicated developments of the COVID-19 epidemic, the company’s production and business activities in the first 9 months of the year still achieved positive results thanks to proactively strictly following anti-epidemic measures, sticking to the plan. and respond flexibly to the needs of the market.

The third quarter of 2021 is the quarter most heavily affected by the Covid 19 pandemic, major cities such as Hanoi, Ho Chi Minh, Da Nang and other provinces all have to implement social distancing according to Directive 15, 16 of the Prime Minister. However, due to the proactive response to difficulties and the solidarity of all employees of the Corporation, in the first 9 months of the year, the Corporation still maintained the production, business and production activities of the units. The position is stable, keeping workers safe as well as preventing the spread of disease in the community.

Viglacera Corporation has Steering Committees for COVID-19 prevention and control at its units and Covid Safety Teams in projects and operating areas of the Industrial Park, propagandizing and mobilizing the whole Corporation to implement. epidemic prevention and control measures under the guidance of the Ministry of Health and competent agencies; Develop plans for epidemic prevention and control of units in cases of isolation / isolation / blockade according to decisions of competent authorities; Prepare medicines, medical supplies, logistical relief teams… to take the initiative, ensure that business activities are not affected; Directors/Heads of units are responsible for regularly updating developments and reporting to the Head of the Steering Committee for Epidemic Prevention and Control of the Corporation.

Production units of the Corporation implement “3 on-site” to maintain production

In addition, the Corporation has actively contacted State management agencies and front-line hospitals to deploy a series of COVID-19 vaccines for all officers, employees and worker of the Corporation.

Beside that, the trade union system has strengthened the implementation of anti-epidemic propaganda measures at the unit and closely followed the epidemic situation, continuously updated the situation with the Corporation’s Trade Union to promptly supporting trade union members, employees and units, ensuring health and safety care for employees throughout the Corporation.

Since the outbreak of COVID-19, consumer shopping behavior has changed from shopping activities outside of stores and supermarkets to online shopping at home. Understanding that, Viglacera accompanies customers during the COVID-19 season with the Viglacera Shop Online e-commerce channel (www.viglacera.vn) and many attractive promotions such as: Offering product combos selection based on synchronous criteria of designs, models, features and prices suitable for customers; free shipping policy; gift programs, discounts… Viglacera Shop Online has really created a different shopping experience, becoming the first choice in the building materials market of Vietnamese consumers.

Efforts to perform the “dual goal” of both fighting the epidemic and developing production were recorded with the results in September and the first 9 months of the year having exceeded the targets of the 2021 Plan approved by the General Meeting of Shareholders. In which, the profit before tax of the parent company in the first 9 months of the year reached 127% of the year plan, an increase of 353 billion over the same period and the consolidated profit of the whole Corporation reached 104% of the year plan, an increase of 350 billion over the same period.

In the list published in early June 2021, Viglacera Corporation (VGC) was voted in the Top 50 best listed companies on the stock market in 2021 by Forbes Vietnam. The ranking of 50 best listed companies in Vietnam this year was announced by Forbes Vietnam in the context of the country’s efforts to combat the 4th wave of COVID-19 outbreak. The business results of listed companies over the past time partly show their bravery, ability to adapt, even boldly invest, and prepare to take advantage of development opportunities when the pandemic is over. As well as the effectiveness from the support thanks to the loosening monetary policies, the solutions to support businesses to restore production by the Government, ministries and branches.

One of Viglacera Corporation’s activities to support the prevention of Covid-19

During the outbreak from the beginning of May 2021 until now, Viglacera has contributed more than 20 billion VND through the Fatherland Front Committees in localities such as Bac Ninh, Phu Tho, Bac Giang, Quang Ninh, Ha Nam, etc. Thai Binh and Thua Thien Hue, and government vaccine funds. The contribution of Viglacera Corporation in the construction and completion of the field hospital once again demonstrates Viglacera’s sense of responsibility to society, the community and the country.

Speaking at the Quarter three briefing, Chairman of the Corporation’s Board of Directors Nguyen Van Tuan noted Viglacera’s results achieved in the past 9 months, despite the market’s difficulties, the Covid pandemic has directly affect the production and business activities of the whole Corporation, but in difficulties, Viglacera has proved the determination to overcome difficulties to achieve good results. The last three months of the year are still difficult challenges when entering the new normal, Viglacera needs to ensure the dual goals of safe and effective production and business, sticking to the set goals and orientations, and planned for 2022 with new breakthroughs.

- Published in News