Viglacera Corporation – JSC: TOP 50 best listed companies in Vietnam in 2021

In the list published in early June 2021, Viglacera Corporation (VGC) was voted in the Top 50 best listed companies on the stock market in 2021 by Forbes Vietnam.

The ranking of 50 best listed companies in Vietnam this year was announced by Forbes Vietnam in the context of the country’s efforts to fight the 4th wave of Covid-19 outbreak. The business results of listed companies over the past time partly show their bravery, ability to adapt, even boldly invest, and prepare to take advantage of development opportunities when the pandemic is over. As well as the effect from the support thanks to the loosening monetary policies, solutions to support businesses to restore production by the government, ministries and sectors.

Viglacera Corporation was officially listed on the Ho Chi Minh Stock Exchange (HOSE) in 2019

The companies in the list of honorees in 2021 are selected from the companies with the best business results, listed on the Ho Chi Minh City Stock Exchange (HoSE) and the Hanoi Stock Exchange (HNX), with a solid foundation, not only has good business results in 2020 but is also expected to be resilient in the context that the Vietnamese economy has faced the most challenges in the past 10 years.

“For more than a year of struggling with difficulties due to the pandemic, the business results of many businesses on the list show the bravery of entrepreneurs, the ability to turn around, and boldly invest to find opportunities, bring positive business results and contribute to the development of the economy”, a representative of Forbes Vietnam commented on this year’s list. Viglacera Corporation is one of 5 raw materials enterprises in this list.

Viglacera Energy Saving Glass production line

2020 is a year of crisis for the whole economy due to the impact of the global Covid pandemic, in that difficult time, Viglacera Corporation has firmly overcome and proved its intrinsic strength with outstanding results. remarkable. The Corporation’s profit reached VND 841 billion, up 12% of the plan, of which the parent company’s profit was VND 736 billion, up 23% of the plan. Consolidated revenue of the Corporation reached VND 9,433 billion, exceeding 14% of the plan, other expenses also basically followed the plan assigned by the General Meeting of Shareholders.

Sticking to specific orientations and goals throughout the implementation process, with the drastic direction and management of the Corporation’s leaders, the solidarity, attachment and high determination of the leadership, manager and employees of the Corporation, As a result, the Corporation has completed the targets of the production and business plan in May and the first 5 months of 2021.

The 50 best listed companies in 2021 are ranked from the selection of companies with the best business results, listed on the Ho Chi Minh City Stock Exchange (HSX) and the Hanoi Stock Exchange ( HNX). Most on the list are companies that have established a competitive position in the market, leading not only in their field of operation but also in the whole economy. Forbes Vietnam evaluates calculated data on the following criteria: compound growth rate of revenue and profit, ROE-ROC ratio and EPS growth for the period 2016-2020; Qualitative survey to assess the level of sustainable development of the enterprise: the company’s position in the industry, the source of profits, the quality of management, the prospect of industry development.

Evaluation data based on the audited financial statements of the enterprise, its dependent subsidiaries or having a low business position are not considered.

- Published in News

National Assembly Chairman urges stepping up vaccine strategy

National Assembly Chairman Vuong Dinh Hue has asked for stepping up the vaccine strategy with a specific roadmap and measures to achieve herd immunity, thus laying an important foundation to catch up with the global economy.

National Assembly Chairman Vuong Dinh Hue at the event (Photo:DUY LINH)

He reiterated the Politburo’s stance on continuing to realise the dual goals of fighting the pandemic and ensuring macro-economic stability and the safety of finance-banking and public debts.

The leader suggested continuing with the 5K+technology message, considering vaccination a strategy; and enhancing international cooperation in seeking vaccine supplies.

In order to effectively perform socio-economic development policies and provide support for those hit by the pandemic, NA Chairman Hue asked the Government to soon issue a growth scenario, accelerate the disbursement of public investment, continue improving business environment, developing private and digital economy, and stimulating domestic demand while boosting collaboration to effectively direct fiscal-monetary policy, and soon bring the Resolution adopted by the 13th National Party Congress into life.

Lawmakers reported that the NA and its Standing Committee issued nine resolutions and documents to ease difficulties amid the pandemic.

As a result, payment of VND 99.2 trillion (US$ 4.3 billion) worth of added value tax, corporate and individual income tax, land lease for 57,000 business households and 128,600 firms has been extended, along with VND 19.3 trillion in special consumption tax for automobiles last year.

Source: NDO/VNA

- Published in News

Vietnam to lead Southeast Asia in growth

The Vietnamese economy will be the fastest growing in Southeast Asia this year at 6.7 percent driven by a manufacturing recovery and boom in trade.

The regional average will be 4.4 percent, a report released in May by the Asian Development Bank (ADB) forecast.

Vietnam’s GDP growth is expected to top 7 percent next year, also the highest in the region, which would average 5.1 percent.

Vietnam’s GDP is set to expand 6.5% in 2021, higher than the global average of 6%, and then rebound to 7.2% next year, according to the International Monetary Fund (IMF) in its latest World Economic Outlook report. Such growth would put Vietnam as the second fastest growing economy among five major economies of ASEAN (Indonesia, Thailand, Vietnam, the Philippines and Malaysia) along with Malaysia, and behind the Philippines at 6.9%, revealed the report.

“Vietnam’s economic fundamentals remain robust. The country has been one of the world’s best-performing economies during the pandemic; that said, we are closely watching the domestic COVID-19 situation,” said Tim Leelahaphan, economist for Thailand and Vietnam, Standard Chartered, in the bank’s recent Global Research report entitled “Vietnam – Strong performance continues this year”.

In forecasts published in April – when the 4th wave had not yet occurred in Vietnam, Oxford Economics, IMF, World Bank, HSBC are of the opinion that Vietnam’s economy would grow at 6.4%-6.6 %, this level is lower than previous forecasts at the end of 2020, Fitch Solutions only forecast at 7%.

Among international organizations, S&P Global Ratings gives the most optimistic forecast about Vietnam’s economic growth this year. In October last year, S&P expected Vietnam’s GDP growth to reach 11.2%. At the latest forecast on May 21 – when a new wave of COVID-19 occurred in Vietnam, this organization adjusted its forecast for Vietnam’s GDP growth in 2021 to 8.5%. However, this forecast is quite high compared to other organizations.

Source: cafef.vn

- Published in News

Accumulated in the first 5 months of 2021, the profit of Viglacera Corporation has doubled over the same period

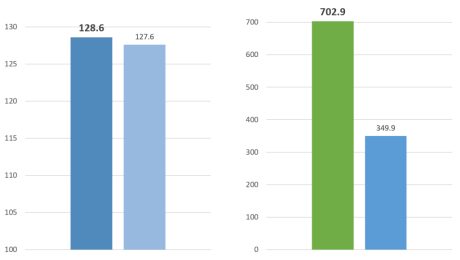

As a result, the Corporation’s profit in May reached 101% of the monthly plan, the accumulated 5 months achieved 69% of the annual plan and the profit doubled compared to the same period in 2020.

The results of recognizing the profit in May 2021 of the whole Corporation and the accumulated profit of the first 5 months of 2021 (unit: billion VND)

Sticking to specific orientations and goals throughout the implementation process, with the drastic direction and management of the Corporation’s leaders, the solidarity, attachment and high determination of the leadership team, As a result, the Corporation has completed the targets of the production and business plan in May and the first 5 months of 2021.

May recorded the return of the 4th Covid-19 epidemic with a great impact on businesses and people’s lives, especially a great disturbance in Industrial Parks, including Yen Phong and Tien Son industrial parks in Bac Ninh.

Calm before handling situations, Viglacera actively cooperated with Bac Ninh Province’s Steering Committee for Epidemic Prevention and Control, jointly supporting activities such as making the worker’s housing area in Yen Phong a place to isolate medical workers. In fact, Viglacera has donated 1 billion VND to frontline doctors, and also contributed 5 billion VND to the Vaccine fund. Currently, activities in Viglacera’s IPs still maintain assurance and compliance with epidemic prevention measures.

For the building materials segment, Viglacera’s production plants are currently being strictly followed by epidemic prevention measures, ensuring stable production and business activities. Commercial business activities still receive cooperation from the entire customer system nationwide, besides, Viglacera’s e-commerce sales on www.viglacera.vn are being maximized.

In addition to the general difficulties of the whole society, Viglacera still found solid directions, maintained and strongly developed production and business activities in both the fields of Real Estate, Industrial Parks and Building Materials. The results of May will be the driving force behind the Corporation’s plans for June and the first 6 months of 2021.

- Published in News